Search Results

allintitle:when does amazon stop accepting venmo

allintitle:when does amazon stop accepting venmo has transformed the way we handle money. Its user-friendly interface and social features made it a favorite among millennials and Gen Z. People love sending payments with just a few taps, whether it’s splitting a dinner bill or paying for services. Amazon recognized this trend and partnered with Venmo to offer customers an additional payment option on its platform.

But now, there’s a buzz in the air as Amazon makes waves with its latest announcement—it’s planning to discontinue accepting Venmo features soon. As shoppers wonder when exactly this will take effect, many are left speculating about what these changes mean for everyday purchases and how they’ll impact both consumers and merchants alike. Let’s dive into what sparked this decision and explore the future of digital payment methods in light of these developments.

Recent announcement from Amazon about discontinuing Venmo payments

Amazon recently made waves with its announcement regarding the discontinuation of Venmo payments. This decision caught many by surprise, especially given the increasing popularity of Venmo as a convenient payment method.

The news arrived amidst growing expectations that digital wallets would become more integrated into major retail platforms. However, Amazon’s move suggests a shift in strategy or perhaps unforeseen challenges in maintaining this partnership.

Customers who have embraced Venmo for their purchases on Amazon are left wondering how this will affect their shopping experience. The ease of using a familiar app to complete transactions has been favored by many.

This change raises questions about what alternatives may be available and whether other popular payment methods could fill the void left by Venmo’s exit from Amazon’s platform. As consumers adapt to these changes, they might seek different avenues for online shopping payments.

Possible reasons for this decision

Amazon’s decision to discontinue Venmo payments could stem from several strategic considerations. One possibility is the desire to streamline payment processing. Managing multiple payment methods can complicate the checkout experience.

Another reason might be related to security concerns. As digital transactions continue to rise, companies like Amazon prioritize secure and reliable payment options. If Venmo’s security protocols don’t align with Amazon’s standards, this could raise red flags.

Additionally, competition within the digital wallet space may play a role. With alternatives like PayPal and Apple Pay gaining traction, Amazon might focus on partnerships that offer better integration or customer loyalty benefits.

It could simply come down to user demand. If consumer patterns indicate fewer customers are utilizing Venmo for purchases on Amazon, reevaluating its acceptance makes business sense.

Impact on customers and merchants

The decision to discontinue Venmo payments on Amazon will undoubtedly create ripples among both customers and merchants. For users, this means losing a convenient payment option they’ve grown accustomed to. Many have relied on Venmo for its speed and simplicity, especially for those spontaneous purchases.

Merchants might also feel the heat from this change. With fewer payment options available, there’s potential for reduced sales conversions. Customers often seek flexibility in how they pay; limiting those choices could lead some to shop elsewhere.

Moreover, it can affect customer loyalty. Shoppers appreciate brands that cater to their preferred methods of transaction. When these preferences are not met, it may prompt them to explore competitors who offer more diverse payment solutions.

This shift highlights an ongoing tension between traditional e-commerce platforms and rising digital wallets seeking market share.

Alternatives for using Venmo on Amazon

If you’re a Venmo user, the news about Amazon discontinuing Venmo payments might be disappointing. However, there are alternative payment methods you can explore on the platform.

One option is to use credit or debit cards for your purchases. They offer security and rewards that can enhance your shopping experience.

Another popular choice is PayPal, which remains widely accepted across many online retailers, including Amazon. Linking it with your bank account allows for seamless transactions.

Amazon gift cards provide another way to pay without relying on traditional banking methods. You can purchase these from various outlets or even earn them through promotions.

Consider using digital wallets like Apple Pay or Google Pay if they’re available in your region. These options allow you to make quick and secure transactions while enjoying the benefits of mobile technology.

What this means for the future of digital payment methods

The discontinuation of Venmo payments by Amazon raises important questions about the future landscape of digital payment methods. As consumers seek convenience, platforms must adapt quickly to evolving preferences.

This shift may signal a move towards more integrated and secure payment solutions. Companies might focus on developing proprietary systems that enhance user experience while ensuring safety.

Additionally, traditional financial institutions could step up their game. They may prioritize partnerships with major retailers to provide seamless transactions.

Emerging technologies like blockchain might also gain traction in response to these changes. Such innovations promise faster processing times and reduced fraud risks.

As competition intensifies, we can expect new players in the market, offering diverse options for consumers. This evolution could reshape how we think about online shopping and payment flexibility moving forward.

Is this a sign of larger changes in the industry?

The decision by Amazon to stop accepting Venmo payments may signal broader shifts within the digital payment landscape. As companies pivot towards more proprietary systems, they might prioritize integrations that align closely with their brand.

Consumers are increasingly valuing seamless experiences, prompting businesses to explore exclusive partnerships. This could lead to a rise in tailored payment solutions designed specifically for individual platforms.

Moreover, regulatory pressures and security concerns are likely influencing these moves. Businesses want to ensure that transactions not only remain convenient but also secure from evolving threats.

As competition heats up among digital wallets and payment processors, companies will be compelled to innovate constantly. The way we transact online is changing rapidly; this announcement may just be the tip of the iceberg in a much larger transformation ahead.

Conclusion:

As the digital landscape continues to evolve, changes like Amazon’s decision on Venmo payments prompt conversations about consumer preferences. Many shoppers appreciate seamless transactions and diverse payment options.

The shift away from Venmo could lead customers to explore new avenues for their online purchases. This transition may even spur loyalty among users who favor other platforms.

Merchants will also feel the impact of this change. They need to adapt quickly in a competitive market where flexibility matters most.

While uncertainties loom regarding future payment methods, innovation remains at the forefront of financial technology. Emerging solutions might reshape how we view shopping experiences altogether.

Staying informed is key as these developments unfold. The industry is dynamic, and staying ahead can make all the difference for both consumers and businesses alike.

FAQs:

As the news about Amazon discontinuing Venmo payments spreads, many questions arise among consumers and merchants alike. Here are some common inquiries:

When does Amazon stop accepting Venmo?

While no specific date has been announced, it’s clear that changes are on the horizon. Keep an eye out for official updates from both companies.

Why is Amazon discontinuing Venmo payments?

There could be a variety of reasons, including strategic business decisions and the desire to streamline payment options.

What should I do if I prefer using Venmo?

Consider linking your Venmo account to other accepted payment methods on Amazon or explore alternative online retailers that still accept Venmo.

Are there other digital wallets available on Amazon?

Yes! Options like PayPal, Apple Pay, and even gift cards can serve as alternatives for customers who want to avoid traditional credit card transactions.

Will this affect my current purchases made with Venmo?

No immediate impact should occur; any existing transactions or subscriptions will remain unaffected until further notice regarding new policies.

Search Results

Preventing ERR_CONNECTION_CLOSED: Tips for Maintaining a Stable Internet Connection

Have you ever been in the middle of an important task online, only to be abruptly interrupted by the dreaded ERR_CONNECTION_CLOSED message? It’s frustrating, isn’t it? This error can leave you feeling lost and annoyed, especially when you’re trying to access critical information or enjoy your favorite streaming service. Understanding what causes this pesky connection issue is key to preventing it from happening again. Let’s dive into how you can maintain a stable internet connection and keep those interruptions at bay!

Understanding the Causes of ERR_CONNECTION_CLOSED

ERR_CONNECTION_CLOSED is a frustrating error that can disrupt your browsing experience. Understanding its causes is essential for effective troubleshooting.

One common reason behind this error lies in server issues. If the server hosting the website you’re trying to access has problems, it may forcibly close connections, resulting in ERR_CONNECTION_CLOSED on your end.

Network interference can also play a significant role. Firewalls or antivirus software might mistakenly block certain connections, leading to abrupt disconnections.

Another cause involves browser settings and extensions. Occasionally, incompatible add-ons or outdated configurations can interfere with how your browser connects to websites.

An unstable internet connection contributes significantly to this issue. Fluctuations in connectivity can lead browsers to prematurely drop communication with servers, triggering the dreaded error message you want to avoid while online.

Tips for Maintaining a Stable Internet Connection

A stable internet connection is essential for smooth browsing. Start by ensuring your browser and operating system are up to date. This makes certain you have the latest security patches and features.

Next, take a look at your network settings. Sometimes, simple misconfigurations can lead to connectivity issues that cause ERR_CONNECTION_CLOSED errors.

Clearing your browser’s cache and cookies can also help. Over time, stored data may corrupt or slow down performance.

Another quick fix is restarting your router and modem regularly. This refreshes the connection and can resolve temporary glitches.

If you’re using Wi-Fi, consider switching to an Ethernet cable when possible. Wired connections offer more stability than wireless ones, reducing the likelihood of interruptions during important tasks or streaming sessions.

A. Update Your Browser and Operating System

Keeping your browser and operating system updated is crucial for a stable internet connection. Outdated software can create compatibility issues, leading to errors like ERR_CONNECTION_CLOSED.

Regular updates ensure you have the latest security patches and features. These improvements help prevent crashes or interruptions that can disrupt your browsing experience.

Most browsers offer automatic update options. Make sure this feature is enabled so you won’t miss important changes. For your operating system, check for updates periodically in the settings menu.

An updated environment improves overall performance too. It minimizes the risk of bugs that could contribute to connection problems. Take a few moments each month to verify that everything is current; it’s an easy step towards maintaining your online stability.

B. Check Your Network Settings

Network settings play a crucial role in maintaining a stable internet connection. If you encounter the ERR_CONNECTION_CLOSED error, it’s worth diving into these configurations.

Begin by checking your IP address settings. Ensure that they are set to obtain automatically unless specific configurations require otherwise. Misconfigured static IPs can lead to connectivity issues.

Next, examine your DNS settings. Using Google’s public DNS (8.8.8.8 and 8.8.4.4) can sometimes resolve persistent connection problems.

Don’t forget about the proxy settings as well; make sure no unwanted proxies are enabled, which could interfere with your browsing experience.

If you’re using a VPN or firewall software, check their settings too—they might be blocking necessary connections without you realizing it! A quick review of these network parameters often leads to smoother online navigation and fewer interruptions.

C. Clear Your Browser’s Cache and Cookies

Clearing your browser’s cache and cookies is a crucial step in maintaining a stable internet connection. Over time, these files accumulate, potentially causing conflicts that lead to errors like ERR_CONNECTION_CLOSED.

When you visit websites, your browser saves bits of data to help load them faster next time. However, outdated or corrupted cache files can disrupt this process. Deleting them can resolve many loading issues.

Cookies track information about your visits but might become problematic if they are corrupted or expired. Regularly clearing them not only improves performance but also enhances privacy.

Most browsers make this simple. Navigate to the settings menu and look for options related to privacy or history. A quick click can refresh your browsing experience and eliminate those pesky interruptions caused by ERR_CONNECTION_CLOSED.

D. Restart Your Router and Modem

Restarting your router and modem can work wonders for a stable internet connection. It’s often the simplest step to troubleshoot issues like ERR_CONNECTION_CLOSED.

When you restart these devices, you’re essentially refreshing their settings. This action clears temporary glitches that may cause interruptions in connectivity.

Unplugging them from power for about 30 seconds allows capacitors to fully discharge, giving them a fresh start. After plugging them back in, wait until all the lights stabilize before trying to reconnect.

This method is quick and effective, yet many overlook it when facing connection problems. Make it a habit to restart your equipment periodically; it could help prevent future disruptions too.

A simple reset might just be what you need to maintain that seamless browsing experience you crave.

E. Use an Ethernet Cable Instead of Wi-Fi

Switching to an Ethernet cable can significantly improve your internet connection. Unlike Wi-Fi, which relies on radio signals that can be disrupted by walls and other objects, a wired connection is direct and stable.

Using an Ethernet cable means less latency. This means faster response times when you’re browsing or gaming online. It’s particularly beneficial for activities that require steady bandwidth.

Additionally, you won’t have to deal with fluctuating signal strength from distance or interference from other devices operating on the same frequency. With a simple plug-and-play setup, it boosts reliability instantly.

For gamers or streamers who rely on constant connectivity, this change can make all the difference in performance and experience. If you’re serious about maintaining a stable Internet connection, consider making the switch to wired networking today.

Common Mistakes That Can Lead to ERR_CONNECTION_CLOSED

Many users unknowingly make mistakes that can trigger the ERR_CONNECTION_CLOSED error. One common blunder is having outdated browser extensions. These add-ons can conflict with your browsing experience, leading to unexpected disconnections.

Another issue arises from improper firewall settings. Sometimes, overly strict security measures block legitimate connections, causing frustration and interruptions.

Neglecting to check for malware also plays a significant role. Malicious software can disrupt network stability by altering essential configurations or consuming bandwidth.

Using public Wi-Fi networks without caution might expose you to connectivity problems as well. Unstable signals often result in dropped connections, contributing directly to this annoying error.

Moreover, failing to keep your router firmware updated can create compatibility issues between devices and services online. This oversight may lead to frequent disconnects during web browsing sessions.

Additional Solutions for Persistent ERR_CONNECTION_CLOSED

If you still encounter ERR_CONNECTION_CLOSED despite trying common fixes, consider flushing your DNS. Open the Command Prompt and type “ipconfig /flushdns.” This can refresh your connection settings.

Another useful step is disabling any VPNs or proxies temporarily. Sometimes these services can interfere with your browsing experience, leading to unwanted errors.

You might also want to check for malware or adware on your device. Running a comprehensive scan with reliable antivirus software can help eliminate any hidden threats that disrupt connectivity.

Adjusting network settings like MTU size could provide relief as well. Access your router’s configuration page to make necessary changes if you’re comfortable navigating those options.

Reaching out to your Internet Service Provider may uncover issues on their end affecting connection stability. They often have insights into outages or technical difficulties in your area.

Conclusion

Maintaining a stable internet connection is essential for smooth online experiences. Being proactive can help you avoid frustrating interruptions like ERR_CONNECTION_CLOSED.

Implementing the tips outlined above can enhance your connectivity. Regular updates, proper network settings, and routine maintenance go a long way in preventing errors.

Stay informed about common mistakes that might lead to this issue. Awareness is key in troubleshooting.

If problems persist despite these efforts, exploring additional solutions may be necessary. Sometimes professional guidance or advanced configurations are needed.

Embrace technology with confidence by adopting these practices. You’ll enjoy a more reliable connection and uninterrupted browsing sessions as a result.

FAQs

What does ERR_CONNECTION_CLOSED mean?

ERR_CONNECTION_CLOSED is an error message that indicates your browser was unable to establish a stable connection with the website you’re trying to access. This can happen due to various reasons, such as network issues or server problems.

How can I fix ERROR_CONNECTION_CLOSED on Chrome?

To fix this issue on Chrome, try clearing your browser’s cache and cookies, updating your browser, checking your network settings, or restarting your router. If these steps don’t work, using an Ethernet cable may improve stability.

Is ERR_CONNECTION_CLOSED caused by my internet provider?

While it could be related to issues with your Internet Service Provider (ISP), it’s essential first to check local factors like hardware connections and software settings before attributing the problem solely to them.

Does antivirus software cause ERR_CONNECTION_CLOSED errors?

Yes, sometimes antivirus programs or firewalls block specific websites inadvertently. Adjusting their settings may resolve the issue.

Can I prevent ERR_CONNECTION_CLOSED from happening in the future?

Maintaining updated browsers and operating systems while regularly checking network configurations will help minimize occurrence. Additionally, periodically clearing cache and ensuring stable connections are beneficial practices for long-term stability.

Search Results

Future Projections for GME Stock: Expert Insights and Predictions

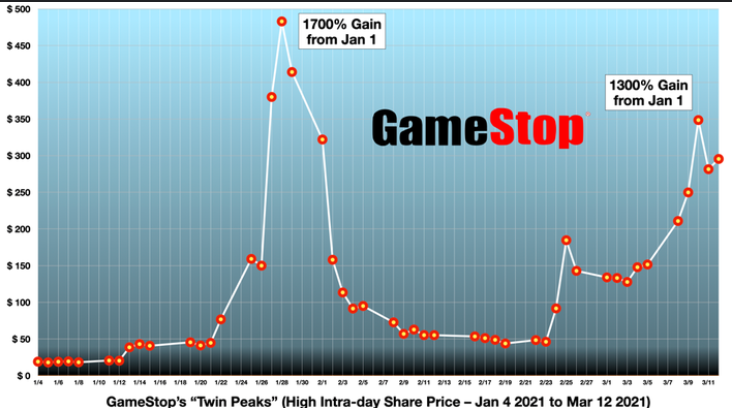

GME stock has become a household name, captivating investors and casual observers alike. Once merely the stock of a traditional video game retailer, GameStop transformed into a symbol of retail investor power in early 2021. With wild price fluctuations and an army of passionate supporters from online communities like Reddit’s WallStreetBets, GME stock has made headlines time and again.

But what does the future hold for this electrifying asset? As we delve deeper into market trends, consumer behavior shifts, and company strategies, it’s clear that GME is at a crossroads. This blog post will explore recent performance metrics while unpacking key factors that could shape its trajectory moving forward. Whether you’re an avid trader or just curious about the hype surrounding GME stock, there’s plenty to uncover!

Recent History and Performance of GME Stock

GME stock has had a rollercoaster ride in recent years. Once considered a lagging player in the retail gaming sector, it suddenly soared to fame in early 2021. The infamous short squeeze captured investors’ attention and sent prices skyrocketing.

The surge was fueled by an army of retail investors on platforms like Reddit’s WallStreetBets. This community-driven movement challenged traditional market dynamics, propelling GME into the spotlight.

Since then, volatility has been a constant companion for GME. Fluctuating between highs and lows, its performance reflects not just company fundamentals but also investor sentiment influenced by social media trends.

Earnings reports have shown mixed results as GameStop attempts to adapt to changing consumer behaviors. Efforts toward e-commerce expansion have added another layer of complexity to its financial narrative.

Factors Affecting GME Stock’s Future Projections

The future of GME stock is influenced by multiple factors. One major element is the role of online communities, particularly forums like Reddit. These platforms have the power to rally investors and create significant volatility in stock prices.

Consumer behavior also plays a crucial role. As e-commerce continues to grow, traditional retail faces challenges. Gamers now prefer digital purchases over physical copies, impacting GME’s sales trajectory.

Additionally, GME’s restructuring efforts cannot be overlooked. The company has embarked on strategic partnerships that aim to enhance its market presence and adapt to changing consumer needs. This evolution may attract new investors looking for innovative growth opportunities.

As these dynamics unfold, they will shape investor sentiment and price movements for GME stock moving forward. Each factor interplays uniquely with others, creating a complex landscape worth monitoring closely.

A. The Influence of Reddit and Online Communities

The rise of GME stock is inseparable from the power of Reddit and online communities. Platforms like r/WallStreetBets have transformed ordinary traders into a formidable force in the financial markets. Here, retail investors share tips, strategies, and memes that often lead to dramatic price swings.

These online forums foster a sense of camaraderie among users. The thrill of being part of something larger fuels enthusiasm for investing in companies like GameStop. This collective mindset drives up demand and influences stock prices significantly.

Social media’s reach amplifies trends almost instantly. When discussions ignite on these platforms, they can propel GME stock into the spotlight with remarkable speed. Traders watch these forums closely for signals that could impact their decisions.

As new generations engage with investment through social media channels, GME’s trajectory remains intertwined with this digital culture. It’s not just about numbers; it’s about community engagement and shared aspirations driving market movements.

B. Changes in Consumer Behavior and E-commerce Trends

The landscape of retail has transformed dramatically in recent years. As more consumers turn to online shopping, traditional brick-and-mortar businesses face significant challenges. GME Stock is no exception.

Gaming enthusiasts are increasingly opting for digital downloads over physical copies. This shift could impact GameStop’s revenue streams and market position. The convenience of e-commerce appeals to a tech-savvy generation eager for instant access to games and content.

Moreover, subscription services like Xbox Game Pass change how players engage with gaming. They prioritize accessibility over ownership, altering purchasing habits and reducing demand for physical game sales.

GameStop’s response will be crucial as they pivot toward an integrated online presence while maintaining their core brand identity. Understanding these behavioral changes can provide insight into the future trajectory of GME Stock amidst evolving industry dynamics.

C. Company Restructuring and Strategic Partnerships

GameStop has embarked on a significant transformation journey. The company’s restructuring efforts aim to adapt to the rapidly evolving gaming industry and consumer demands.

Leadership changes have been pivotal in this process. New executives bring fresh perspectives, focusing on revitalizing GameStop’s business model. This includes optimizing physical store operations while enhancing online shopping experiences.

Strategic partnerships are also playing a crucial role. Collaborations with tech companies could pave the way for innovative product offerings and services. These alliances may help GameStop tap into new revenue streams beyond traditional retail sales.

Investors are closely watching these developments. Success in restructuring and forming valuable partnerships could bolster confidence in GME Stock’s future performance, potentially leading to a more stable financial outlook as it navigates industry shifts.

Expert Insights on GME Stock’s Future Performance

Financial advisors are closely monitoring GME stock, providing varied insights. Some express caution due to market volatility and changing consumer habits. They highlight that while the initial hype captured attention, sustained growth requires robust performance metrics.

Industry experts emphasize the importance of strategic partnerships. Collaborations with tech firms could enhance GameStop’s e-commerce capabilities, positioning it better in a digital landscape.

Analysts remain divided on price predictions. While some forecast potential spikes driven by community enthusiasm, others point out fundamental weaknesses that may hinder long-term stability.

Market sentiment plays a critical role as well. Social media trends can sway investor behavior dramatically—keeping in mind how quickly enthusiasm can shift is essential for anyone considering GME stock investments.

As these expert opinions illustrate, navigating the future of GME stock involves balancing optimism with realism amid ever-evolving market dynamics.

A. Analysis from Financial Advisors and Analysts

Financial advisors and analysts have taken a keen interest in GME stock, especially after its meteoric rise. Many experts are cautious yet optimistic about its future.

Some analysts believe GME’s volatile history could present both risks and opportunities for investors. They emphasize the need for careful evaluation of market trends and the company’s fundamentals before making any moves.

Others point out that the retail investor community remains a significant force driving GME’s value. The enthusiasm from platforms like Reddit has reshaped traditional investment strategies.

However, financial professionals also warn against speculative trading driven solely by social media hype. Balancing excitement with thorough research is essential for anyone looking to invest in GME stock.

Staying informed on industry shifts can provide valuable insights into potential price movements as well.

B. Opinions from Industry Experts and Execut

Industry experts and executives have varied opinions on GME stock, reflecting the dynamic nature of the market. Some believe its volatility presents both risks and opportunities for investors. They emphasize that understanding market sentiment is crucial.

Others highlight GameStop’s pivot towards e-commerce as a game-changer. This shift could enhance revenue streams, making the company more resilient in an increasingly digital world.

However, skepticism lingers among some analysts regarding sustainability. They caution that relying heavily on community-driven hype might not provide long-term stability.

Additionally, industry veterans discuss how strategic partnerships could bolster GME’s position in the gaming sector. Collaborations with tech companies may open doors to innovative products and services.

As always, staying informed about expert insights can help investors navigate these uncertain waters effectively. The landscape surrounding GME stock remains fluid; every opinion carries weight in shaping future expectations.

Conclusion:

The future of GME stock remains a topic of great interest. Investors are keenly observing the dynamics at play.

Market trends and consumer behaviors will likely shape its trajectory. The influence of online communities cannot be overlooked either. These platforms have transformed how stocks are discussed and traded.

Company strategies, including potential partnerships, could also impact performance. Keeping an eye on corporate restructuring is essential for informed decision-making.

Expert opinions add another layer to this discussion. Financial analysts provide valuable insights that investors should consider when evaluating their positions.

Staying updated with developments in the gaming industry will be crucial as well. With rapid changes occurring, adaptability may become key for both GME and its shareholders.

FAQs:

What is the current status of GME stock?

As of now, GME stock has been experiencing a rollercoaster ride in the market. Investors continue to keep a close eye on its performance, influenced by various external factors such as consumer trends and online sentiment.

How does Reddit influence GME stock movements?

Reddit communities play a significant role in shaping the narrative around GME stock. The collective buying power of retail investors galvanized through platforms like WallStreetBets can lead to rapid price changes.

Are there any strategic partnerships that could affect GME’s future?

Yes, GameStop has pursued several strategic partnerships aimed at enhancing its e-commerce capabilities and overall business model. These collaborations may provide new revenue streams and help stabilize the company’s financial health.

What should investors consider before investing in GME stock?

Investors should assess their risk tolerance thoroughly. Given the volatility associated with meme stocks like GameStop, it’s essential to conduct comprehensive research and possibly consult financial advisors for personalized insights.

Where can I find expert opinions on GME’s future projections?

You can find expert analysis from financial news outlets, investment blogs, or even through social media channels where analysts share their insights regularly about market trends related to stocks like GME.

Search Results

nvidia stock: Analyzing the Growth Potential in a Competitive Landscape

nvidia stock has become a household name in the world of technology, known for its cutting-edge graphics processing units (GPUs) and innovative solutions. From powering video games to advancing artificial intelligence, NVIDIA’s impact on various sectors is undeniable. But how did this tech giant rise to prominence?

Founded in 1993, NVIDIA started as a small player in the semiconductor industry. Over the decades, it grew into a leader with an impressive portfolio that includes gaming hardware and software technologies driving modern computing. As demand for high-performance graphics continues to soar, many investors are keenly eyeing NVIDIA stock.

What does the future hold for this powerhouse company? The GPU market is competitive and ever-evolving, making it essential to understand both NVIDIA’s position and its potential growth trajectory. Let’s dive deeper into what makes NVIDIA tick amidst fierce competition and shifting consumer demands.

Overview of the Graphics Processing Unit (GPU) Market

The Graphics Processing Unit (GPU) market has evolved significantly over the past decade. Initially dominated by gaming, GPUs now power a range of applications, including artificial intelligence and data analytics.

This expansion is driven by increasing demands for high-performance computing. Industries are leveraging advanced graphics capabilities to enhance their workflows. Gamers and creators alike seek superior visual experiences, fueling demand.

As technology advances, the competition intensifies among major players. Innovations in architecture and processing power constantly reshape the landscape. Consumers benefit from improved products that deliver enhanced performance at competitive prices.

Market trends indicate a shift toward integrated solutions as well. Companies are exploring ways to streamline processes with hybrid systems combining CPUs and GPUs into single packages.

With cloud computing on the rise, GPU usage is expected to surge even further, ensuring this sector remains vibrant and dynamic in the coming years.

Competitors in the GPU Market

The GPU market is a bustling arena, with several key players vying for dominance. AMD stands out as NVIDIA’s most significant competitor. Their Radeon series has made impressive strides in performance and affordability.

Intel recently stepped into the game with its Arc GPUs. While still establishing itself, Intel’s reputation could disrupt traditional dynamics.

Another notable contender is Qualcomm. Though primarily known for mobile processors, they are increasing their footprint in graphics technology. This shift broadens the competition landscape significantly.

Emerging companies like ARM also present potential threats to established giants through innovative solutions and partnerships.

Each of these competitors brings unique strengths to the table, making it essential for NVIDIA to maintain its edge through continuous innovation and strategic maneuvers in this highly competitive environment.

NVIDIA’s Performance and Growth in Recent Years

NVIDIA has experienced remarkable growth over the past few years. The company’s stock has surged, driven by robust demand for its graphics processing units (GPUs). This demand stems not only from gamers but also from industries like artificial intelligence and data centers.

During this period, NVIDIA reported impressive revenue increases. Their gaming segment remains a powerhouse, fueled by new product launches and a booming esports market. Meanwhile, their push into AI applications opens new avenues for growth.

The company’s strategic acquisitions have bolstered its capabilities in deep learning and cloud computing. These moves position NVIDIA as a leader in emerging tech landscapes.

Investors are taking note. Analysts predict continued upward momentum due to expanding markets and innovative technology solutions that leverage GPU power across various sectors.

Key Factors Driving NVIDIA’s Growth Potential

NVIDIA’s growth potential hinges on several key factors that set it apart in the tech landscape.

The booming demand for artificial intelligence (AI) and machine learning applications plays a crucial role. NVIDIA’s GPUs are increasingly being utilized for AI workloads, giving them an edge over traditional processors.

Another vital aspect is its strong foothold in gaming. As more gamers seek high-performance graphics, NVIDIA continues to innovate with powerful GPUs that enhance user experiences. The launch of next-gen graphics cards keeps their offerings competitive and desirable.

Moreover, partnerships with major tech companies bolster NVIDIA’s position. Collaborations across sectors like automotive and cloud computing expand its reach into new markets.

Ongoing advancements in data center technologies create opportunities for growth. With businesses migrating to cloud solutions, NVIDIA stands ready to provide the infrastructure needed to support these transformations.

Risks and Challenges for NVIDIA in the Competitive Landscape

NVIDIA faces significant risks in its pursuit of growth. Intense competition from companies like AMD and Intel poses a constant threat to market share. These rivals are investing heavily in technology, striving to close the gap.

Supply chain disruptions remain a concern as well. Global events can affect component availability, leading to production delays and impacting revenue. NVIDIA’s reliance on semiconductor manufacturing makes this risk particularly salient.

Regulatory scrutiny is another factor that cannot be overlooked. As companies expand, they often attract attention from regulators regarding fair practices and antitrust issues.

Market volatility affects investor confidence too. Fluctuations in stock prices can deter potential investments or lead existing shareholders to rethink their positions.

Evolving consumer preferences may challenge NVIDIA’s ability to predict future trends accurately. Staying ahead requires continuous innovation and adaptation amidst an ever-changing landscape.

Future Outlook for NVIDIA Stock

The future outlook for NVIDIA stock appears promising, driven by innovations in artificial intelligence and gaming. As industries increasingly adopt AI technologies, NVIDIA’s GPUs remain essential, fueling demand.

Recent partnerships with major tech companies enhance its market position. Collaborations focus on developing advanced solutions that push the boundaries of what’s possible in computing. This synergy could lead to increased revenue streams.

Moreover, as gaming continues to evolve with virtual reality and high-performance graphics demands, NVIDIA is well-positioned to capture a larger share of this growing market. The company’s commitment to research and development ensures it stays ahead of competitors.

Investor sentiment remains strong due to consistent performance metrics and strategic expansions into new markets. With its impressive track record in innovation, NVIDIA is poised for sustained growth in the coming years.

Conclusion:

NVIDIA stands at a pivotal point in the tech world. With its innovations and strategic moves, it has carved out a significant niche in various markets.

Investors are keenly watching how the company navigates challenges while capitalizing on emerging opportunities. The demand for GPUs is projected to soar as industries like AI and gaming expand.

While competition remains fierce, NVIDIA’s adaptability sets it apart. Its focus on cutting-edge technology could propel growth further.

As the digital landscape evolves, so will NVIDIA’s role within it. Keeping an eye on its performance can reveal much about future trends in technology investments.

Engagement with investors and analysts will be crucial as developments unfold. This dynamic environment promises intriguing possibilities ahead for NVIDIA stock.

FAQs:

What is NVIDIA known for?

NVIDIA is primarily known for designing GPUs that power gaming computers and graphic-intensive applications but has also expanded into AI technology and data center solutions.

How does NVIDIA compete with other companies?

NVIDIA competes through continuous innovation in GPU technology while also offering software solutions that enhance performance across multiple platforms.

Are there any recent developments related to NVIDIA?

Yes, recent developments include advancements in AI integration within their hardware offerings alongside collaborations with leading firms across various industries.

Is investing in NVIDIA stock risky?

Like all investments, buying NVIDIA shares carries risks due to market volatility and competitive pressures but provides potential rewards based on growth projections in emerging markets.

What factors should I consider before investing?

Consider your risk tolerance, investment goals, market trends affecting technology stocks, as well as how closely you follow news related to company innovations or financial reports.

-

Games5 months ago

Games5 months agoGTA San Andreas Mod APK

-

Games5 months ago

Games5 months agoA Beginner’s Guide to GTA San Andreas Mod APKs: What You Need to Know

-

Tech5 months ago

Tech5 months agoCrossword Conundrums: What Makes the Vault Opener Such a Popular Puzzle Element?

-

Tech6 months ago

Tech6 months agoMaximizing Your Experience on Wepbound: Tips and Tricks for Users

-

BLOG5 months ago

BLOG5 months agoExploring the World of Redgifs: A Comprehensive Guide

-

Entertainment4 months ago

Entertainment4 months agoEverything You Need to Know About the Nothing Phone 3: A Comprehensive Review

-

Entertainment5 months ago

Entertainment5 months agoUnpacking the Allure of Gojo Satoru: Why Ko-fi Fans Can’t Get Enough

-

Entertainment5 months ago

Entertainment5 months agoExploring olympus Scanlation: A Gateway to Unseen Manga Treasures